How to Transfer Lazypay Balance To Bank Account – Convert Lazypay Balance To Bank Account , Lazypay To Bank Without UPI , Transfer Lazypay Amount To Bank , Use Lazypay In Flipkart , Lazypay IDFC First Bank for Lazypay Credit Limit to bank Account Now. If You Can see for Lazypay Penalty Charges and how to increase Lazypay Credit Limit for Just Submitted Required Documents and We Will Guarantee Increase 100% Working Method Here. Don’t Forget Lazypay PayU Cashback Offer – Get Rs.150 Cashback into Bank A/c

What is Laypay? Lazypay is a Free Using Your Approval Credit Limit and Use the Credit Limit Without Any Cost Pay, No Charges Pay, and No Hidden Charges for 15 Days Dues. Download LazyPay Wallet App and Login Your Account. Use the Credit Limit and We Are Happy Shopping.

Now, Recent Launched for LazyPay and Again LazyPay LazyCard Pre-Approve For Upto Limit Rs.30,000 Credit Limit, For The Transfer Your LazyPay Credit Limit, LazyPay Balance to Your Bank Account. Do You have a Following Process Below

Lazypay Pay Credit Balance Used On Your Favrout Stores Like a Flipkart, Amazon, Paytm, etc Much More, Easy Approval Your Credit Limit Without Long process. Hurry Up You Are No use Credit Limit After 15 Days Dues and Dues Complete Than Lazypay App Now. Apply LazyPay LazyCard – Flat ₹500 Cashback on 1st Transaction

How to Transfer Lazypay Balance To Bank Account

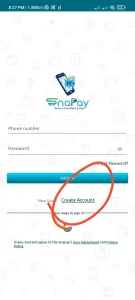

1. Download Snapay App From GPlay Store to Link Here

2. Installing / Open Snapay App and Skip Introduction Part

3. Create New Account & Login You are Account for Very Simple

4. You Are KYC Complete and Fill In the Bank Account Details to Link Your Bank Account Successfully & Completed Your KYC (Very Easy)

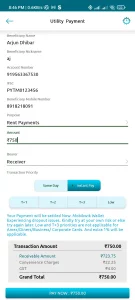

5. Home Dashboard Section > Click On Utility Payment Option and Select Your Bank Account to Direct Transfer Your Bank Account

6. Check Your Bank Details: Select Purpose in Rent Payment, Enter Amount Min.100, and Choose Instant Pay Or Same Day, (T+1, T+2, T+3Dealy Received Payment) and Click On Pay Now Button (Including Charges Just Rs.25)

7. Choose Payment Option > Wallet Payment 1 and Procced to Payment LazyPay Pay Later with no Extra Cost

8. Directly, Go to LazyPay Merchant Site to Login Your LazyPay Account and Use LazyPay Credit Limit and Charges Including Credited

9. Successfully! Complete The Transaction and We Will, Get Instant Transfer on Your bank Account Within 24 Hours Credited Now.

Would i be able to pull out my equilibrium in to some other ledger ? No you can’t pull out into some other bank account. We just help withdrawal into the very record that you have arrangement for programmed reimbursement.

Everyone* has access to a unique credit limit, to use freely to:

Head over to the LazyPay application and fill in a couple of subtleties like Name, PAN, and address.

Check your accessible cutoff for use when you pay later on 100+ applications and sites or upgrade your breaking point by finishing your KYC through simple advanced interaction.

The endorsement from the national bank is subject to “certain forthcoming RBI consistency”, PayU said in an assertion. As per PayU, its conceded installment office called LazyPay observers around 10,000-11,000 exchanges each day. In excess of 800,000 exchanges have effectively occurred utilizing this office.

Note: Using this application/service does not impact your credit score