How to Apply for an IDFC FIRST Bank Credit Card and You Will Get a LifeTime Free IDFC FIRST BANK Credit Card And Get Upto Best Credit Limit Approval on your credit card and lots of benefits this idfc bank credit card now. No Charges, this is absolutely Life Time Free IDFC FIRST Bank Credit Card With Instant Approval

IDFC FIRST Bank offers four lifetime-free cards catering to the varied needs of the users. These cards come with the unique feature of dynamic interest rates, based on the user profile. IDFC FIRST Bank Credit Cards are offered in 4 different variants First Classic, First Select, First Wealth, and First Millennia.

Interest-free cash withdrawal from ATMs for up to 48 days from the date of card issuance by VISA and Lifetime FREE Credit Card, 10X rewards that don’t expire, and Low-interest rates from 9% to 36% per annum.

Benefits & Features –

- Lifetime FREE Credit Card

- 10X rewards that don’t expire

- Zero over-limit fees, zero add-on charges, and zero reward redemption fees

- Interest-free cash withdrawal from ATMs for up to 48 days from the date of card issuance

- Low-interest rates from 9% to 42% per annum

- How to Apply for AU Small Finance Bank Credit Card – Free ₹1500 Cash

- Kotak 811 Bank Lifetime Free Credit Card No Joining Fee + No Annual Fee

- How to Apply for OneCard Free Metal Credit Card to Free Rs.250

- UNI Pay 1/3rd Credit Card Apply – Free Credit Limit Upto Rs.2 Lakh

- ICICI Bank Lifetime Free Credit Card No Joining Fee + No Annual Fee

- How to Apply Indusind Bank Credit Card for FREE & Earn Cashback

- How to Apply LazyPay Lazy Credit Card Free – Flat Rs.500 Cashback

- Axis Bank Lifetime Free Credit Card – Without Joining Fee & Annual Fee

- Bank of Baroda Lifetime Free Credit Card No Joining Fee + No Annual Fee

- Amazon Pay ICICI Bank Credit Card Offer – Apply & Get ₹1500 Cashback

IDFC FIRST Bank Credit Cards are Lifetime Free. Choose from a variety of cards to suit your own needs. Apply Now. Use this link Below…

How to Apply for IDFC FIRST Bank Credit Card: Lifetime Free + Zero Charges

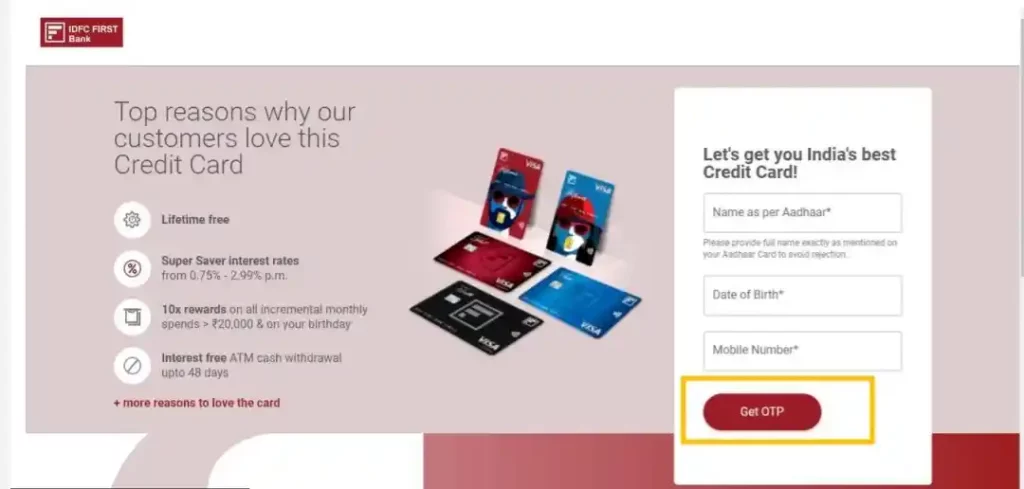

1. First Of All, Visit The Link to Apply for IDFC FIRST BANK Credit Card

2. Enter Your Name & Phone Number and Click on Continue to Apply Now

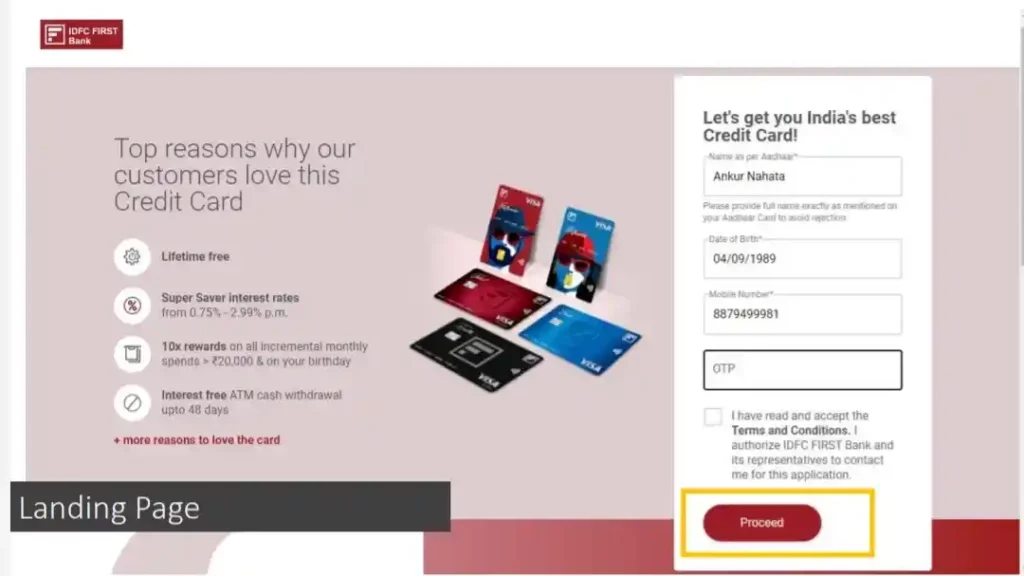

3. Check their basic pre-filled details and add any other required details, accept the terms & conditions and submit

4. Once submitted, Will be redirected to the IDFC FIRST Bank web page

5. Complete the rest of the process on the IDFC FIRST Bank web page

6. Enter the name as per aadhaar, date of birth, mobile number and click on ‘Get OTP’

7. Enter the OTP, accept the terms and conditions and click on ‘Proceed’

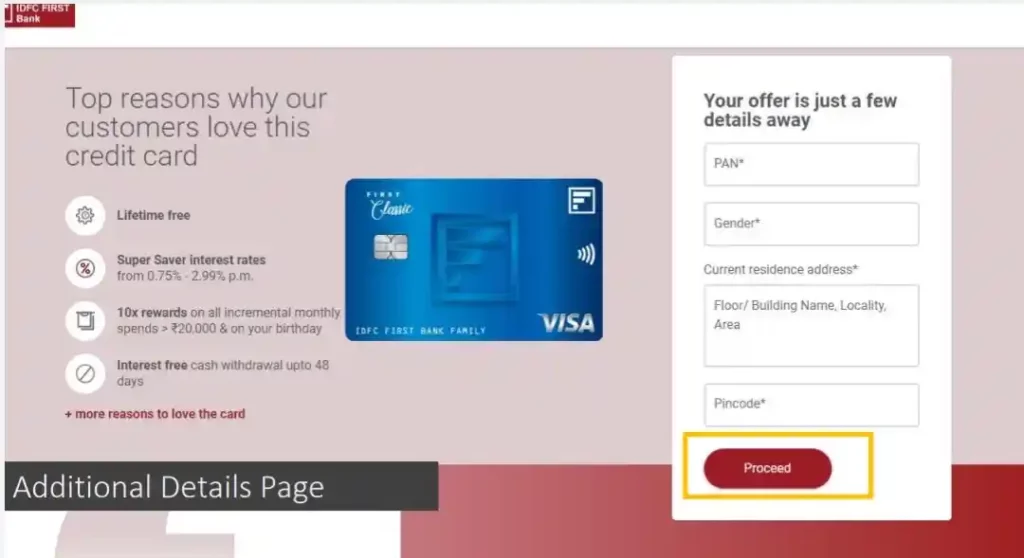

8. Enter the PAN, gender, current residence address, pincode and click on ‘Proceed’

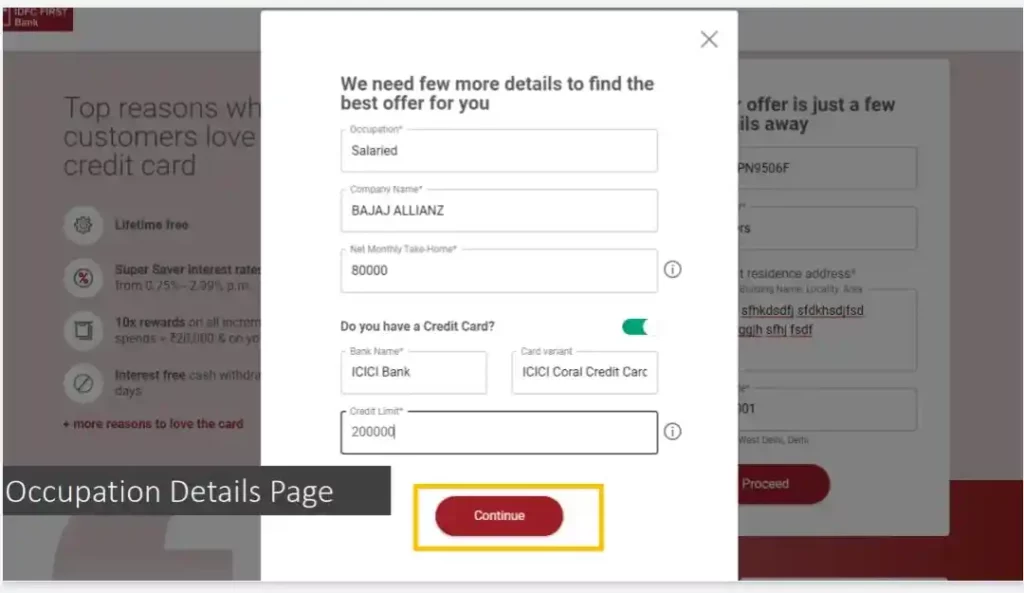

9. Enter few more details such as occupation, company name, etc, and click on ‘Continue’

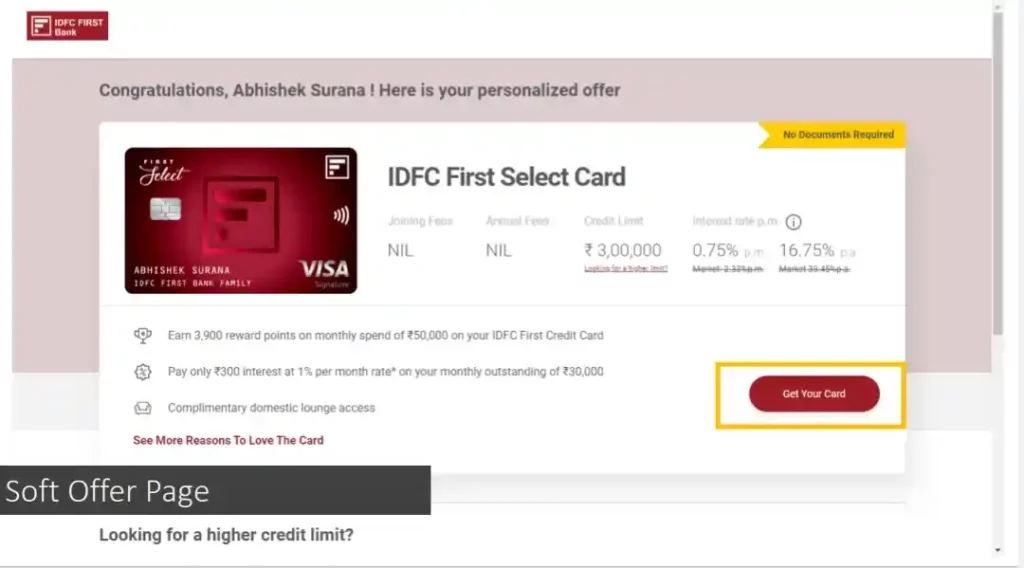

10. The best offer is shown on the screen if a customer is eligible for a credit card. Click on ‘Get your card’

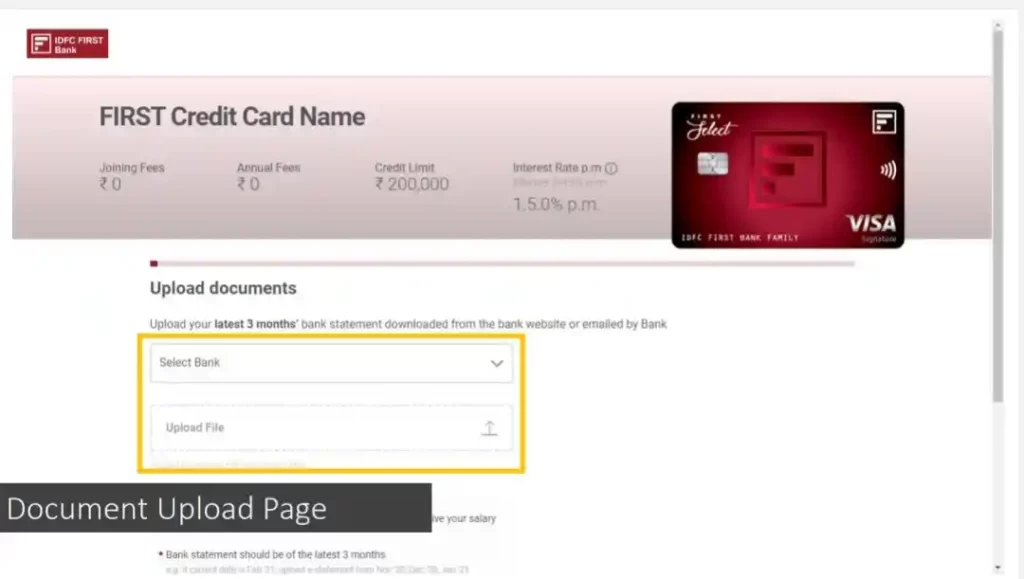

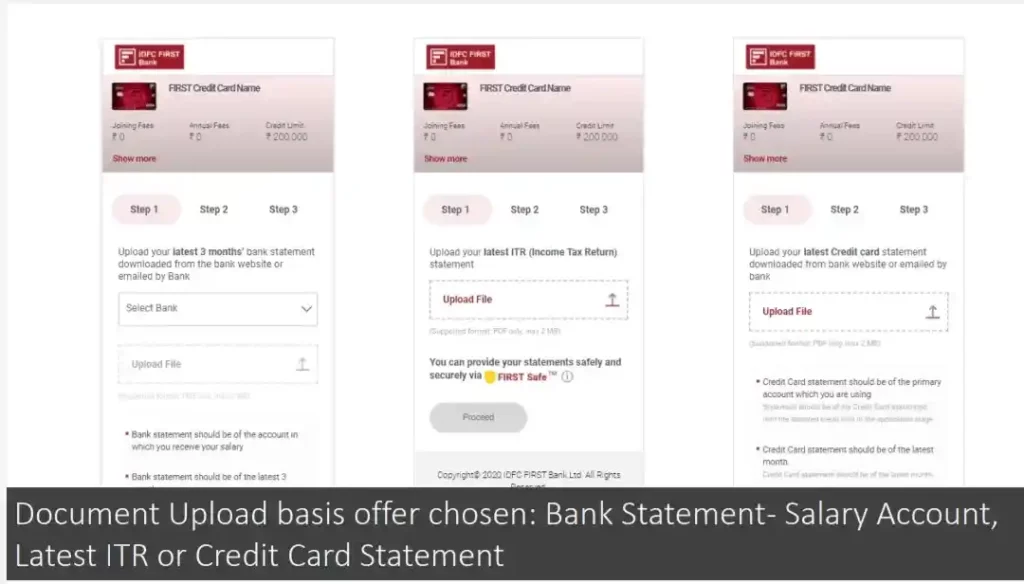

11. Select a bank, upload a bank statement and click on Proceed

12. Note: Document upload basis offer chosen: Bank Statement-Salary Account, Latest ITR or Credit Card Statement

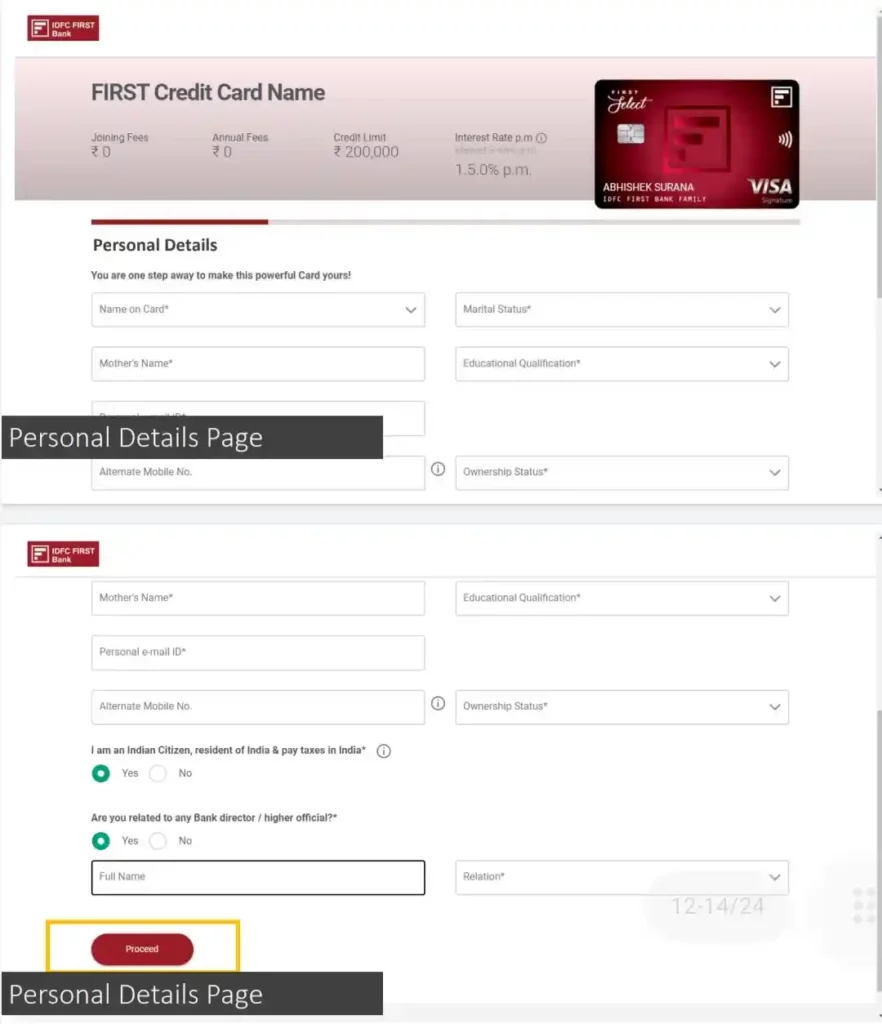

13. Enter the personal details such as name, marital status, etc. and click on ‘Proceed’

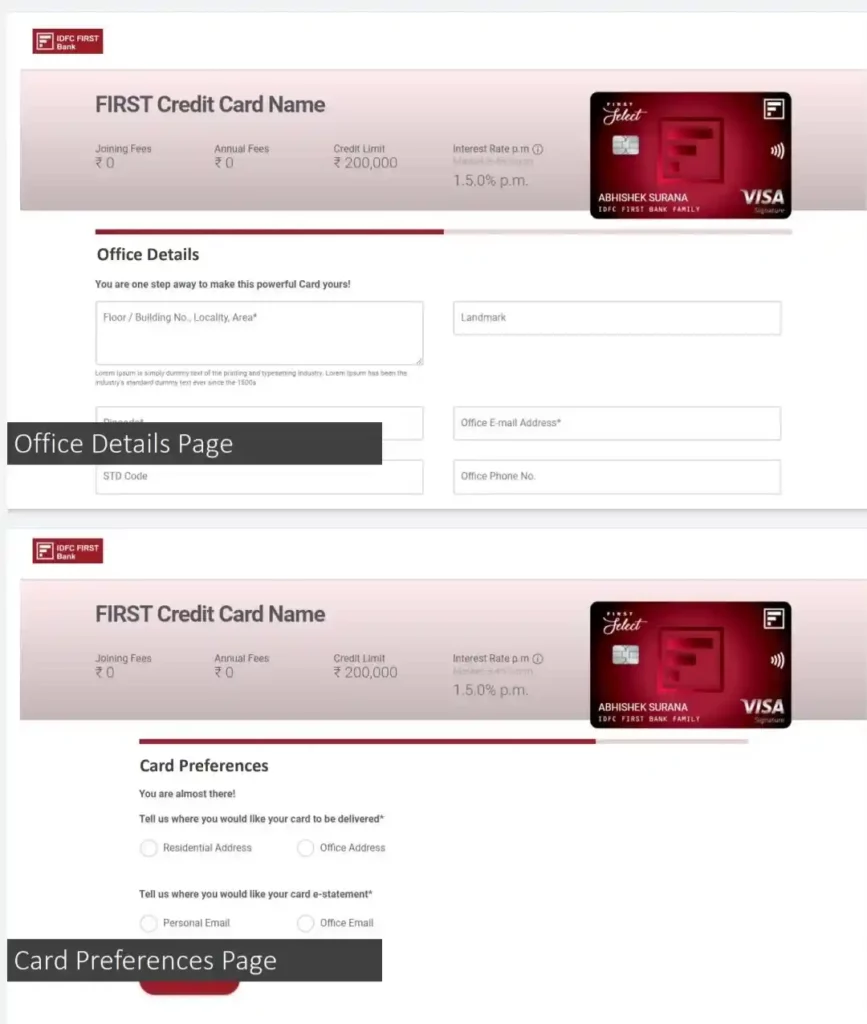

14. Enter office details such as address, phone number, etc., select card preferences and click on ‘Proceed’

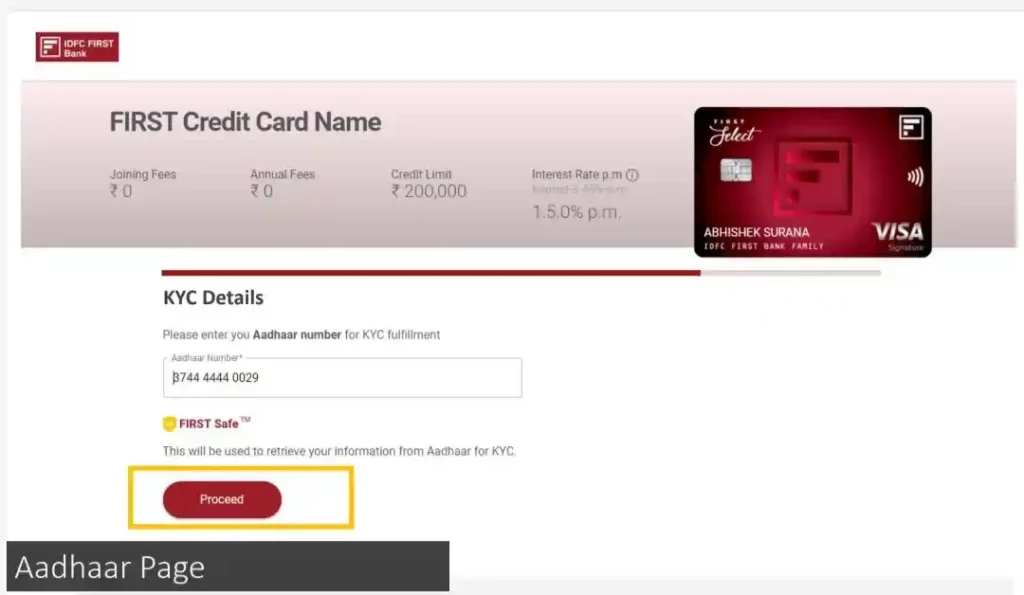

15. Enter KYC details such as Aadhaar number and click on ‘Proceed’

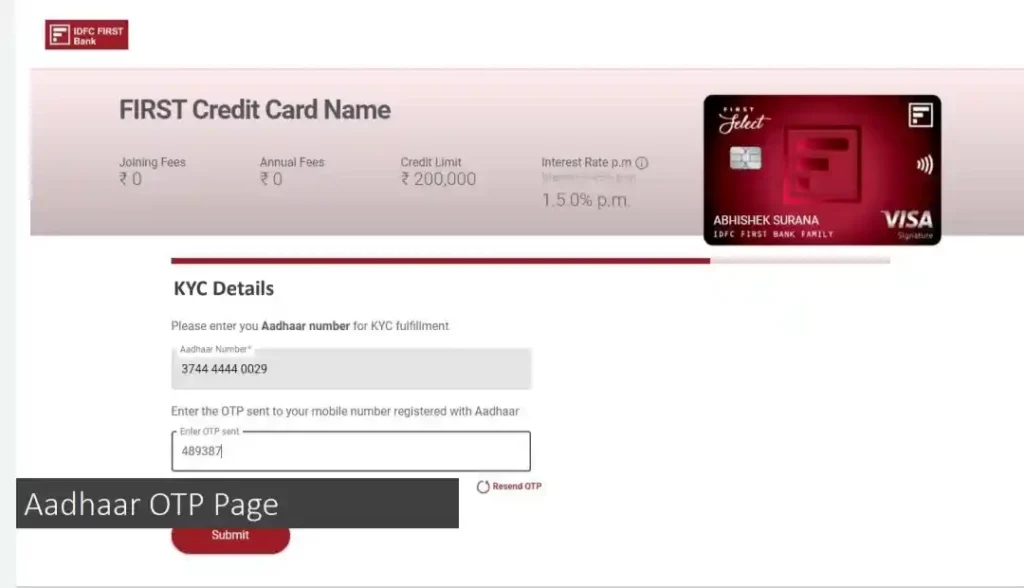

16. Enter the OTP sent to the registered Aadhaar mobile number and click on ‘Submit’

17. Accept the terms and conditions, enter the OTP and click on ‘Proceed”

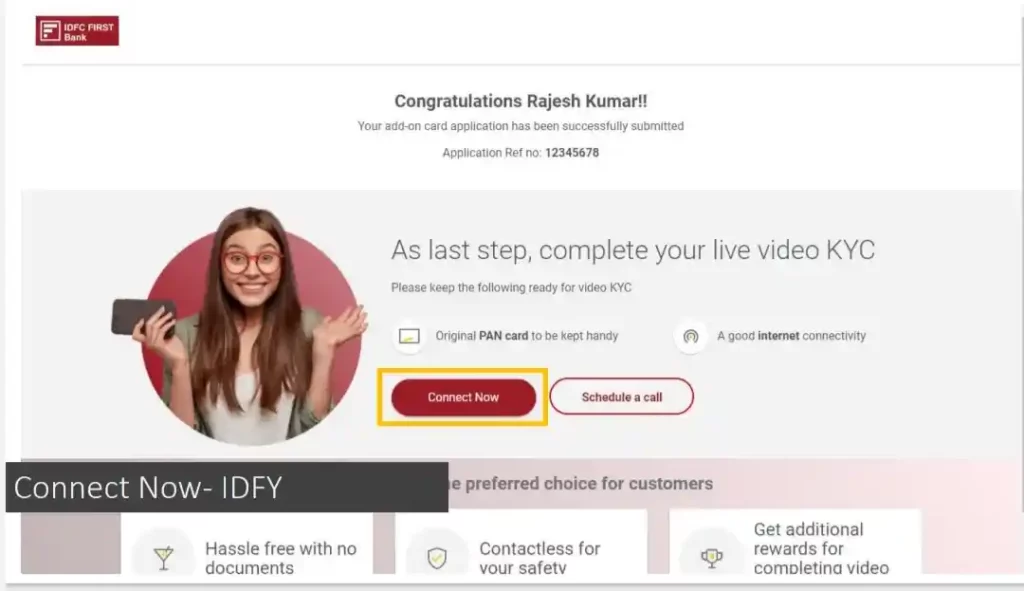

18. Customer needs to complete live video KYC

19. Once the bank approves a credit card application, it may take up to 14-20 working days for the credit card to reach the customer’s registered address

20. If a customer starts the process and fails to complete the process or drops off in the middle of the VKYC stage, the customer can click on this link, do Aadhaar OTP and complete the rest of the process. Video KYC Link : https://www.idfcfirstbank.com/credit-card/vkycl

21. FI Curing Process gives one more chance to the customer to update the proper/complete address. Use this link to complete the FI Curing process- https://www .idfcfirstbank.com/fi-curing/fi-curing-landing