How to Open AU Small Finance Bank Zero Balance Digital Saving Account Savings Account, Free Paytm cash Rs.400 Au Bank Open Saving Account for Successful Account Opening and Funding Minimum Rs.3000 and Get Premium Features Active on your account now. Everything is a paperless digital account and instant account within 5 minutes of the account opening Successfully. Instant Open Free AU Small Finance Bank Savings Account

Hello, Guys Welcome Back Again to the Introducing for New Digital Savings bank account opening now. AU Digital Savings Account is a Full-KYC Savings Account that you can open instantly with Video KYC, from anywhere and at any time.

AU Small Finance Bank Savings Account is a free Feature-rich Debit Card with a small finance BANK Account. High-interest rates & Monthly interest payouts all control Smart banking. A flagship offering, this account aims at providing you with a holistic and hassle-free banking experience through best-in-class features. You can save excess funds in this account and withdraw them anytime.

With an AU Digital savings account, open your account instantly using the Video Banking facility and have access to your banking services from anywhere in a fast, secure, and effortless manner. How does it work? Select AU Digital Savings Account’ for the Zero Balance option.

Contents

Benefits:

- Earn high interest up to 7.25%* p.a.

- 225+ offers on your favorite brands

- Free unlimited online payments

- Enjoy a branch-like experience with Video Banking

- Feature-rich Debit Card

- High-interest rates & Monthly interest payouts

- Paperless banking.

- Smart banking

- Safety & Security

- Relationship convenience

- Up to 7% Interest and no hidden charges, no minimum balance required

- Regular Offers Comes From Swiggy, BMS and Zomato.

- Main benefits: AU Bank Digitel Savings Account of Debit Card Annual Charges Just ₹177 But Apply Every month Amazon Friday Add Money Offer Rs.500 Add Money And and Pay Rs.400 (Rs.100 Discount instant)

Requirement

- Age: 25 years and above

- Yearly Income: 6 Lakh+ Documents:

- Valid Aadhaar Card and PAN Card

- Customer’s details in PAN and Aadhaar card should be the same.

- Mobile Number should be linked to Aadhaar Card

Open Instant AU Bank Digital Savings Account – Zero Balance

Note: Available in limited cities – check eligible pin codes in the app below

1. First of all, Visit the link from Opening AU Bank Digital Savings Account

2. which redirects to the AU Small Finance Bank website where the customer has to complete their account opening application.

3. Add and verify the mobile number linked with Aadhaar.

4. Enter PAN and agree to all the Terms & Conditions.

5. Enter and verify the Aadhaar number using the OTP.

6. Click on ‘Click here to complete the application by yourself’.

7. Following details to be filled in correctly:

– Personal details such as marital status, email id, mother’s name, state, city.

-In case the address you are residing at is different from your permanent address, then please add the current address under the communication address.

– Nominees can be added at this step. It can also be skipped.

– Income details: Occupation Type & Annual Income.

– Select ‘No’ under FATCA declaration if you are an Indian tax resident

– Account details: Select AU Digital Savings Account from the list of options shown. You can opt for getting a Debit Card & Cheque book here. Also select the state, city & branch applicable.

– Customer can fund their account at this step.

9. Verify all the details filled and accept all the Terms and Conditions. Click on confirm and proceed.

10. Proceed to complete your KYC or schedule it later.

11. Allow microphone, camera & location permissions to the web browser.

12. Key things to note during video KYC:

– Original PAN card and paper to be kept handy for verification. Live signatures are to be done by the customer during VKYC.

– Video KYC to be done by the customer only without any prompting

– Customer should be alone in the room while doing Video KYC

– Personal details to be kept handy (name, mobile, email, DOB, parent name, occupation details, etc.).

– Customer to explain in case permanent & current location is different.

– How did the customer hear about the AU Savings Account (your customers can inform that they were referred by their financial advisors).

– Why does the customer wants to open an AU Savings Account (please explain the benefits of the account to the customer).

13. Your income gets credited during the payout cycle, based on the account opening by the customer.

Note:

– AU Savings Account VKYC agents are available only between 8 am to 8 pm from Monday to Saturday.

– Customer shouldn’t be incentivized to open the account.

– Suspicious cases, incorrect details, details mismatch, face mismatch, third-party prompting will lead to rejections.

Terms & Conditions

1. When sharing any brand content or benefits or creatives with your customers, it has to be strictly as per the GroMo app. If any changes are made your account will be blocked.

2. You are not allowed to open Social Media account in the name of the brand, if found doing so, your account will get blocked immediately and penalty will be applied.

3. Funding should be done in the first instance itself and amount should be at least 35100.

4. Age: 25 years and above.

5. No mismatch of names in PAN and Aadhaar card.

6. Applicable only for new users. Users with existing AU Small Finance Bank account are not eligible for the payout.

7. Video KYC is mandatory for account opening.Customer will have the option to do a LIVE video KYC with bank executive to complete their KYC process. The timings for the same are 8 a.m. to 8 p.m. from Monday to Saturday.

8. Original PAN card, pen & paper will be required at the time of video KYC.

9. Customer shouldn’t be incentivized to open the account.

10. Video KYC should be done by the customer only without any prompting.

11. Payout will not be paid if there are multiple accounts opened from the same device.

12. Funding status payout will be considered as per report from the brand, no disputes will be entertained for the same.

Method 2

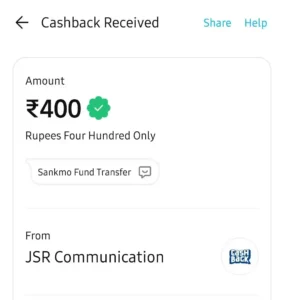

How to Open AU Small Finance Bank Zero Balance Digital Saving Account and Free ₹400 Paytm Cash

1. First Of All, Visit The Link To Open AU Bank Zero Balance Digital Saving Account and Get ₹400 Paytm Cash Instant

- Enter your Paytm number and click submit

- Open an account by using basic details

- Open a bank account for the first time.

- Done !! Your account opened within 5 minutes

- You will get ₹400 Paytm cash within 48 hours

- Note- Valid Only Once Per User/IP Address

- Below Complete Process With Full Step b Step

2. Check their basic pre-filled details and add any other required details, accept the terms and conditions and submit

3. Once submitted, will be taken to the AU SFB Savings Account Web page

4. complete the rest of the process on the Web page AU SFB Savings Account

5. Input customer phone number and verify the OTP to authenticate the Phone number

6. Accept the terms and condition

7. Step 3: Input Aadhar Number and Verify Aadhar with OTP.

8. (Preferred if customer number is mapped with Aadhar card)

9. Upload original PAN Card and E-sign on blank page. Click on “Complete the application by yourself” for Self Journey

10. Input Details: DOB, Spouse Name(Husband/ wife Name), Email ID, Mobile Number, Alternate Mobile Number, Father name, Mothers Name and permanent Address details

11. Select address for Debit Card dispatch – Can be same as permanent address, office address or a new address.

12. Add a Nominee (Not Mandatory) and Nominee Address

13. Add Occupation Type and Income and chose FATCA-CRS Declaration as “No” and click on “Next”

14. Choose the Savings Account that suits your customers needs. List of Accounts: AU Digital Savings Account, AU Platinum Savings Account, AU Royale & AU Savings Account Value

15. Choose Debit Card and Cheque Book and your customer can look for a branch nearby

16. Recheck all details and confirm and proceed to payment

17. Minimum Payment required by the customer is Rs.1000 to”Rs.3000 and if the customer selects a premium account then the payment would be as per the minimum payment of the account

18. Post payment, customer has to complete the vKYC by clicking on the vKYC link

19. For video KYC the customer has to share location and keep Aadhar Card ready

20. You will get a successful AU SFB Savings account opened with Rs.3000 funding (Don’t Worry We Wil Back)

21. Your complete the funding at the time of account opening for you to be eligible for the lots of benefits and delivery cards

FAQ

No, it is not mandatory to deposit funds while opening the account, as it is a zero balance account. However, if a customer deposits 31,000 or more, you will get some additional payout. Payout on funding is as per report shared by brand.

PAN card & Aadhar card

You will receive the payout within 7-10 days, once the customer has successfully opened the account

The minimum age of the customer should be 25 years.

Yes, the customer’s mobile number should be registered with their Aadhar card.

No, you will not receive the payout if the customer is already an existing relation of AU small finance bank.

No, you will not receive the payout if the customer provides a referral code at the time of the onboarding journey.

More: Instant Savings Account

- Apply for Online Kotak 811 Zero Balance Savings Account + Free Debit Card

- Open IndusInd Bank Savings Account – Enjoy Amazing Offers

- Open Axis ASAP Digital Savings Account Online With Video KYC

- NiyoX Open Zero Balance Digital Saving Account Free With Visa Card

- Jupiter Bank Zero Balance Account Opening & Free ₹100 Paytm Cash